Table of Contents

- Corporate Tax Return Deadline 2025 - Alis Lucina

- 2025年报税别拖拉,记住几个重要的截止日! | JKtax

- Corporate Tax Return Deadline 2025 - Alis Lucina

- Why CPA need Outsourcing Tax Preparation Services?

- 2025 Business Tax Deadlines - Imran Gemma

- Tax Due Date 2025 - Laura Olivia

- 2025 Tax Filing Deadline California - Taylor Casey

- Tax Due Date 2025 - Laura Olivia

- Tax Report 2025 Deadline - Kacy Georgine

- Tax Payment Deadline 2025 - Ardene Carlynn

When Are 2025 Taxes Due?

What Is the Deadline for Filing an Extension?

What If I Miss the Tax Filing Deadline?

If you miss the tax filing deadline, you may be subject to penalties and interest on any unpaid taxes. The IRS charges a 5% monthly penalty on unpaid taxes, up to a maximum of 25%. Additionally, you may be charged interest on unpaid taxes, which accrues daily. To avoid these penalties, it's essential to file your taxes on time or request an extension.

Can I File for an Extension Online?

Yes, you can file for an extension online using the IRS Free File program or through a tax software provider. You can also file Form 4868 by phone or mail. Be sure to have your tax information ready, including your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

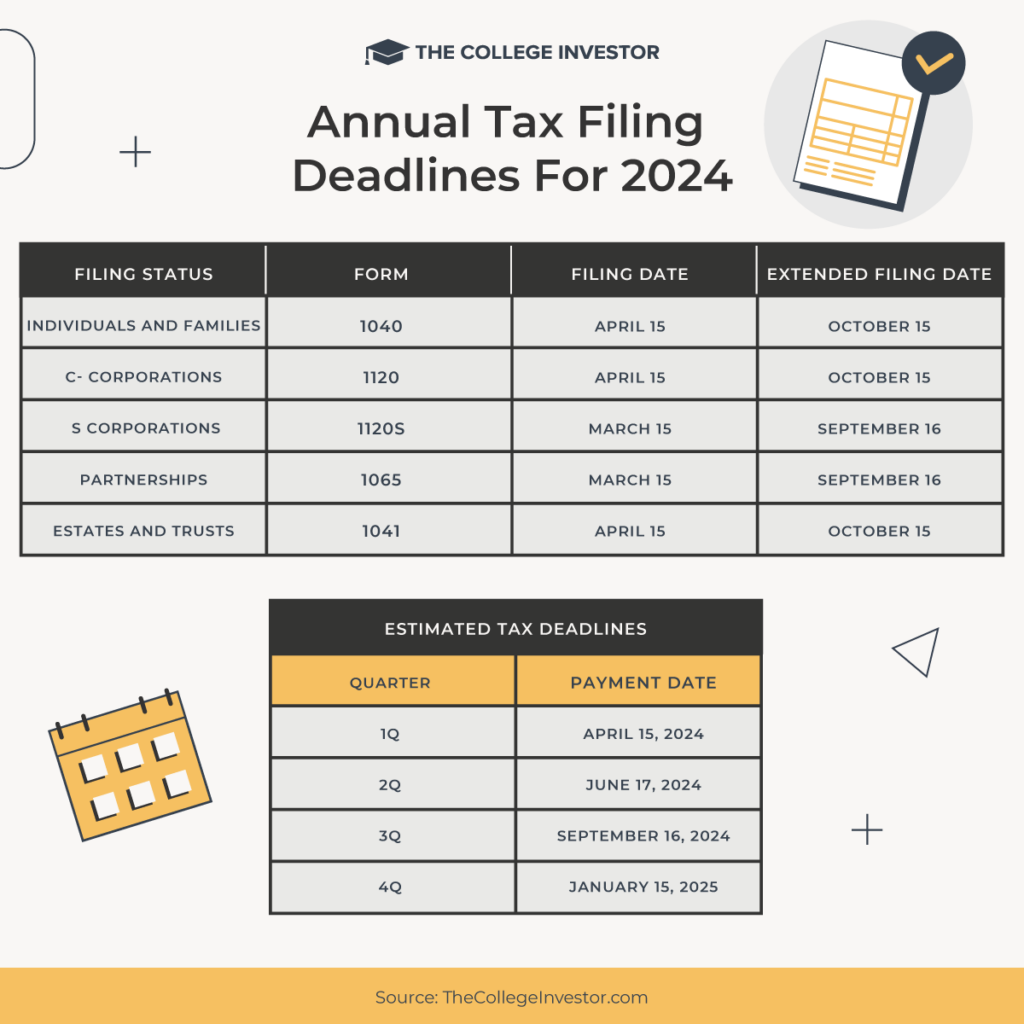

What About Business Tax Deadlines?

Business tax deadlines vary depending on the type of business and tax form. Here are some key deadlines to keep in mind: Partnership tax returns (Form 1065): March 15, 2025 S corporation tax returns (Form 1120S): March 15, 2025 C corporation tax returns (Form 1120): April 15, 2025 Staying on top of tax deadlines is crucial to avoid penalties and ensure a smooth filing process. By knowing the key deadlines, including the April 15, 2025, tax filing deadline and the October 15, 2025, extension deadline, you can plan ahead and file your taxes with confidence. Remember to also consider business tax deadlines and take advantage of online filing options to make the process easier. If you have any questions or concerns, consult with a tax professional or visit the IRS website for more information.Keyword density: IRS tax deadline, 2025 tax season, tax filing deadline, tax extension, business tax deadlines.

Note: The article is written in a way that is easy to understand, and the HTML format is used to make it SEO-friendly. The title is new and descriptive, and the headings are used to break up the content and make it easier to read. The article is approximately 500 words, and the keyword density is moderate to ensure that it ranks well in search engine results.