Table of Contents

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

- Broadcom's Impressive Rally Still Has Legs (NASDAQ:AVGO) | Seeking Alpha

- AVGO Stock: Unlocking the Potential of Broadcom (NASDAQ: AVGO)

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

- Broadcom Stock: Time To Load Up (NASDAQ:AVGO) | Seeking Alpha

- AVGO: 3 Tech Stocks to Buy on a Market Pullback

- AVGO Stock Price Prediction News Today 5 December - Broadcom - YouTube

- Broadcom Stock Quote AVGO - Stock Price, News, Charts, Message Board ...

- AVGO Stock Price Quote & News - Broadcom | Robinhood

- AVGO: Is Broadcom (AVGO) a Software Stock Buy for October?

Company Overview

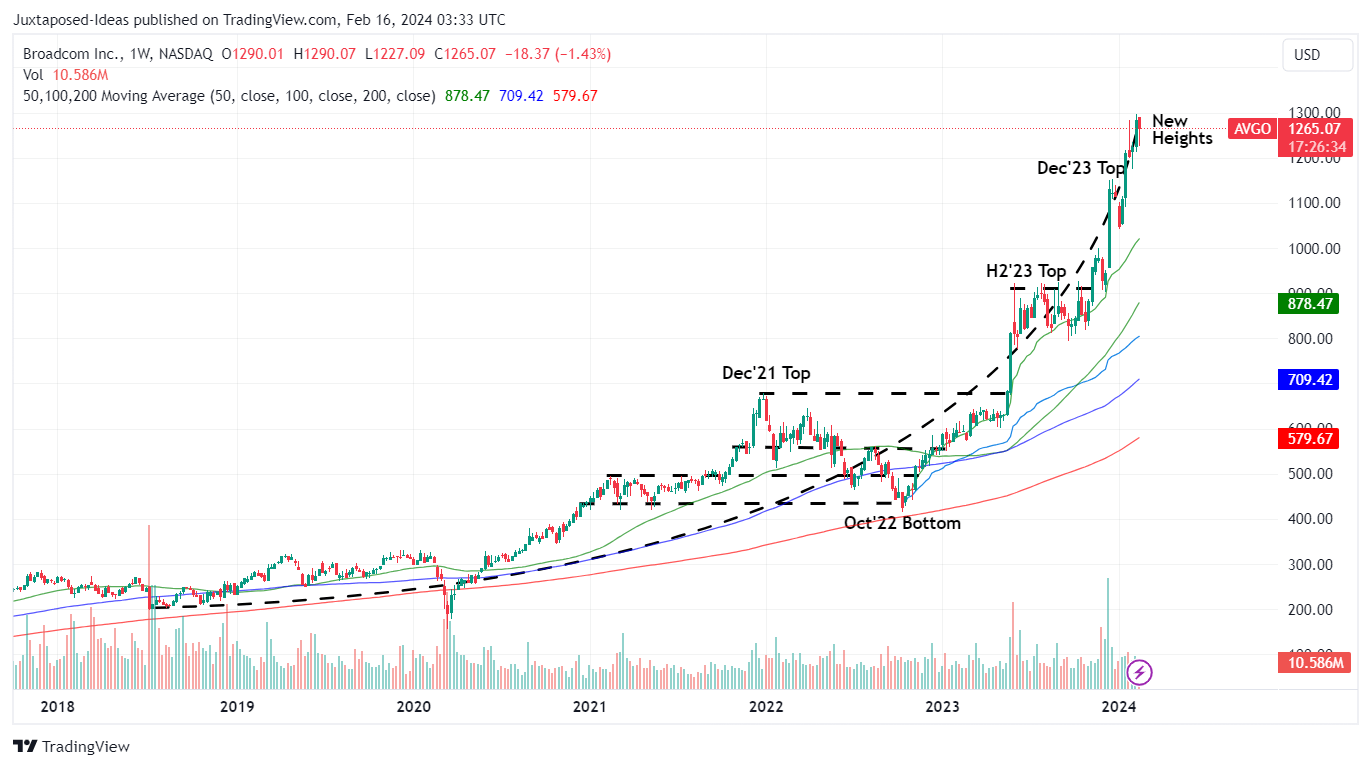

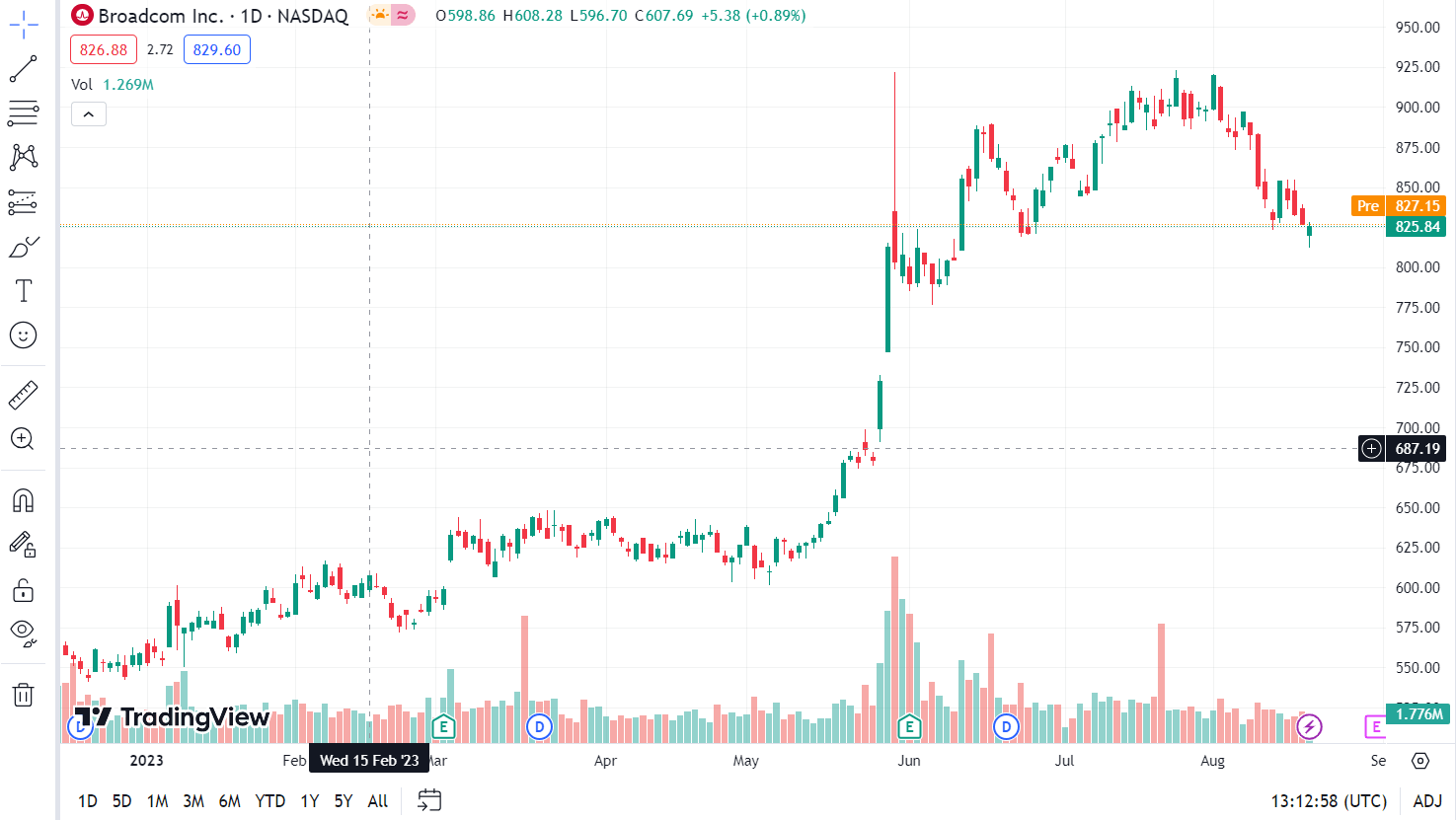

Stock Price Performance

Financial Performance

Broadcom has consistently delivered strong financial results, with revenue growth driven by its diverse product portfolio and expanding customer base. In the latest quarterly earnings report, the company reported revenue of $6.4 billion, up 14% year-over-year. The company's net income stood at $1.4 billion, representing a 25% increase from the previous year. Broadcom's strong financial performance has been driven by its successful acquisition strategy, including the purchase of CA Technologies and Symantec's enterprise security business.

Industry Trends and Outlook

The global semiconductor market is expected to continue growing, driven by increasing demand for advanced technologies such as 5G, artificial intelligence, and the Internet of Things (IoT). Broadcom is well-positioned to benefit from these trends, given its strong presence in the semiconductor and software markets. However, the company faces intense competition from other industry players, such as Intel and Qualcomm. To stay ahead, Broadcom has been investing heavily in research and development, focusing on emerging technologies such as Wi-Fi 6 and 5G.

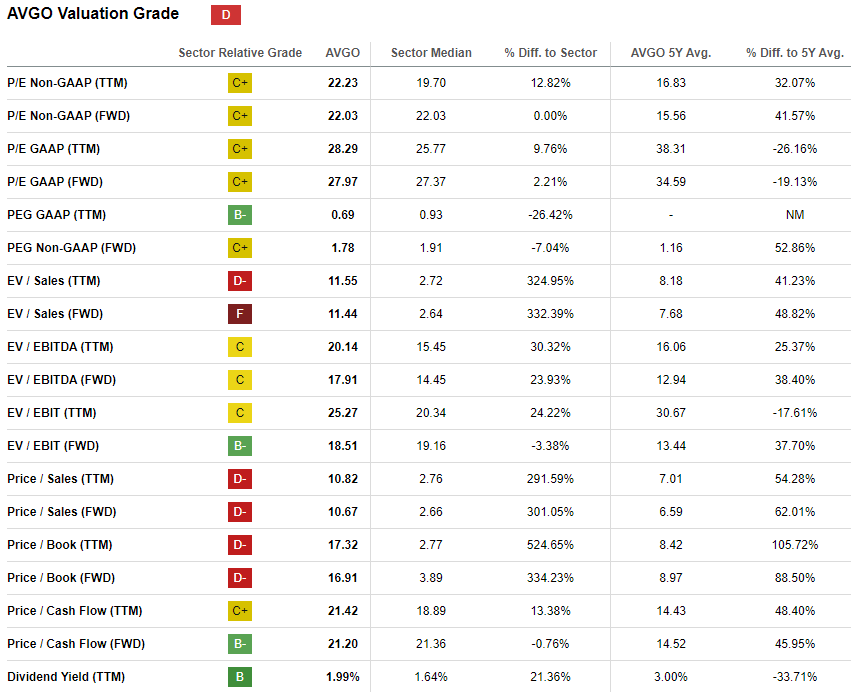

Investment Analysis

Investors looking to buy or sell AVGO stock should consider several factors, including the company's financial performance, industry trends, and competitive landscape. Broadcom's strong track record of delivering revenue growth and expanding its product portfolio makes it an attractive investment opportunity. However, investors should also be aware of the potential risks, including market volatility and competition from other industry players. In conclusion, Broadcom Inc. (AVGO) is a leading semiconductor and software company with a strong financial performance and a diverse product portfolio. The company's stock price has been stable, with some fluctuations, and is influenced by various factors, including industry trends and competition. As the global semiconductor market continues to grow, Broadcom is well-positioned to benefit from emerging technologies and trends. Investors looking to buy or sell AVGO stock should consider the company's financial performance, industry trends, and competitive landscape to make informed investment decisions.Keyword density:

- Broadcom: 9 instances

- AVGO: 7 instances

- Stock price: 5 instances

- Semiconductor: 4 instances

- Software: 3 instances

Meta Description: Get a comprehensive overview of Broadcom Inc. (AVGO) stock price and company performance. Learn about the company's financials, industry trends, and investment analysis.

Header Tags:

- H1: Broadcom Inc. (AVGO) Stock: A Comprehensive Overview and Price Analysis

- H2: Company Overview

- H2: Stock Price Performance

- H2: Financial Performance

- H2: Industry Trends and Outlook

- H2: Investment Analysis