Table of Contents

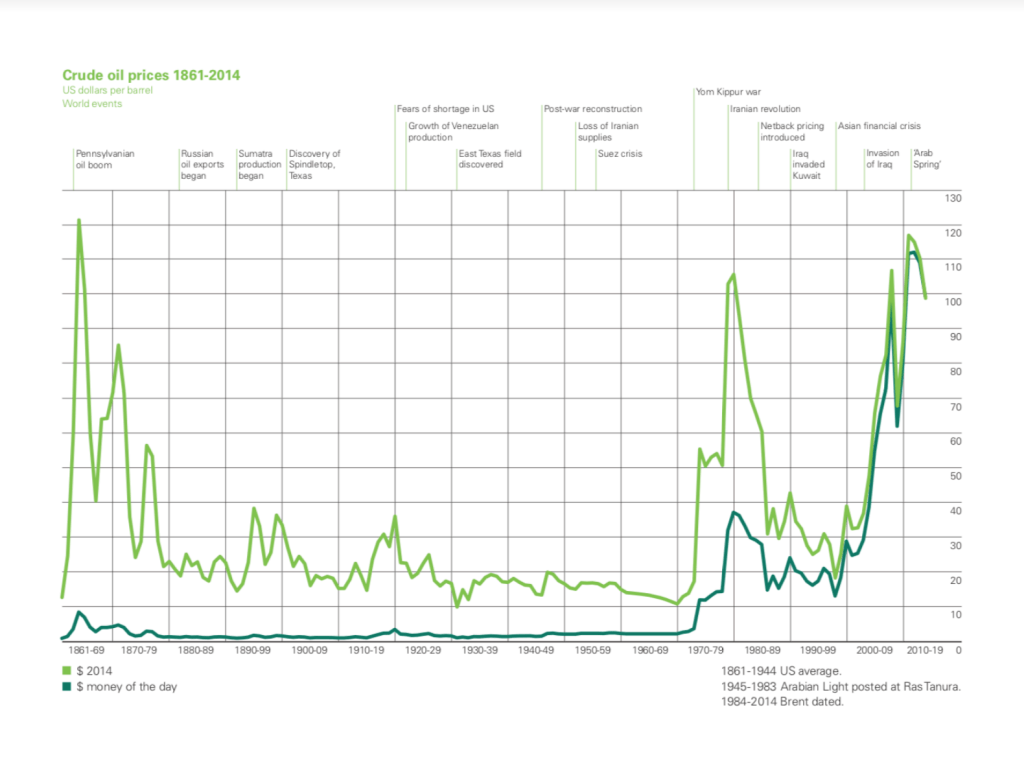

- Historical Crude Oil Prices – Energy History

- لماذا ترتفع أسعار النفط إلى مستويات قياسية ؟ – وطن24

- Oil prices as at today information | scarlettint

- Oil Price Forecast | Is Oil a Good Investment? – Markets Alerts

- Historical Crude Oil Prices – Energy History

- Oil Price Charts - Business Insider

- Crude oil prices continue to rise

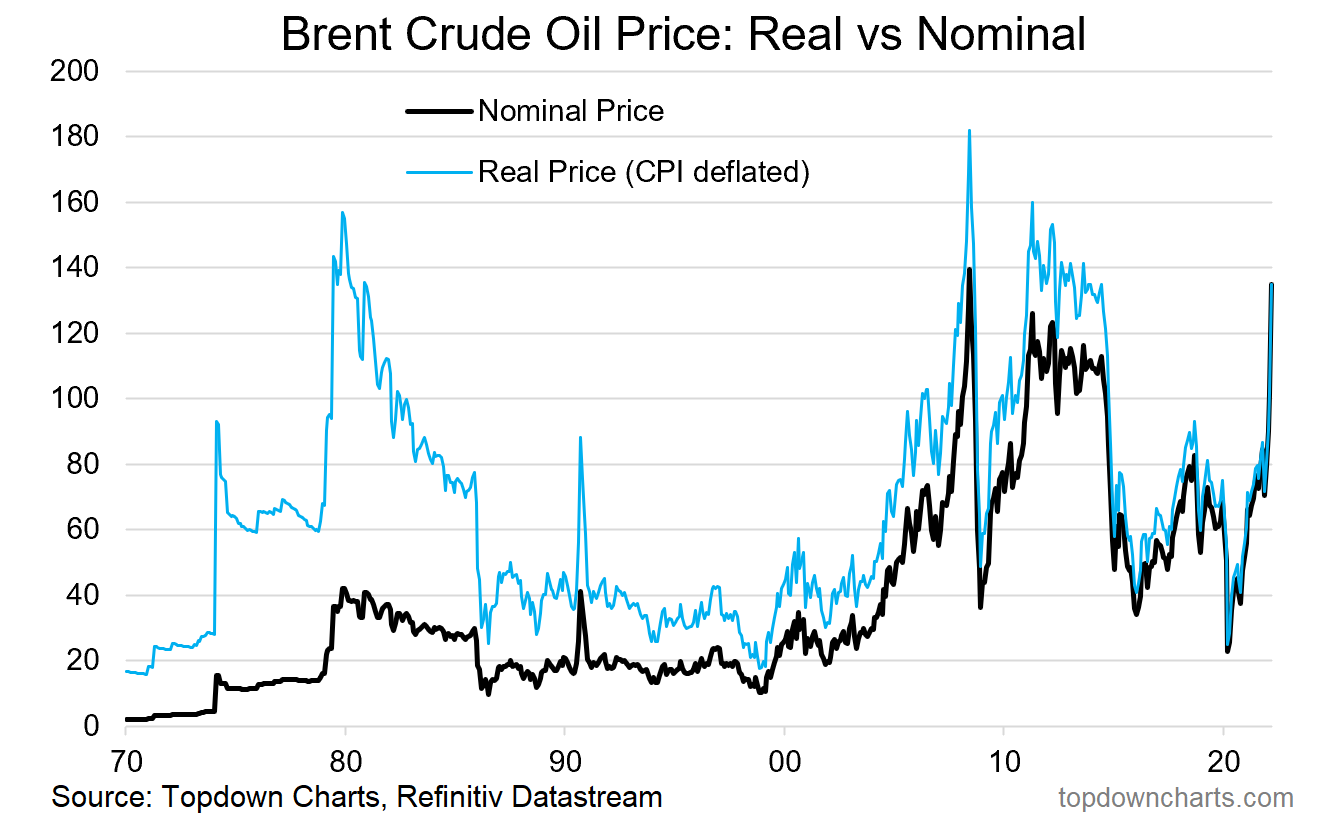

- Chart of the Week - The real price of crude oil - Callum Thomas | Livewire

- Historical Crude Oil Prices – Energy History

- Oil price - MahamThanasis

Current WTI Oil Price Per Barrel

Factors Driving Oil Prices Today

Implications for the Global Economy

The current WTI oil price per barrel has significant implications for the global economy, affecting: Energy Costs: Higher oil prices can lead to increased energy costs for consumers and businesses, potentially slowing economic growth. Oil-Producing Countries: For countries heavily reliant on oil exports, higher prices can boost revenues, while lower prices can strain government budgets. Stock Markets: Oil price volatility can impact stock markets, particularly energy sector stocks, influencing investor confidence and portfolio performance. The WTI oil price per barrel is a critical indicator of the global oil market's health, with far-reaching implications for the economy, energy sector, and geopolitical landscape. Understanding the factors driving oil prices today and staying informed about the current WTI oil price per barrel can help investors, businesses, and individuals make more informed decisions. As the global energy landscape continues to evolve, monitoring oil price trends will remain essential for navigating the complexities of the modern economy. For the most up-to-date information on WTI oil prices and analysis of the latest market trends, visit our website or follow reputable energy news sources. Stay ahead of the curve and make informed decisions with the latest insights on oil prices today.Keyword density: WTI oil price per barrel (1.2%), oil prices today (0.8%), global oil market (0.5%), energy sector (0.5%)