Table of Contents

- Fannie Mae: Εξακολουθεί να βλέπει μια... ύφεση να έρχεται - Radar.gr ...

- Fannie Mae logo in transparent PNG and vectorized SVG formats

- Fannie Mae Corrects Its Title Insurance Pilot Program Mistake ...

- Fannie-Mae-Logo-history – The Golden Newsletter Vietnam

- Fannie Mae to Require .7 Billion Government Cash Infusion - WSJ

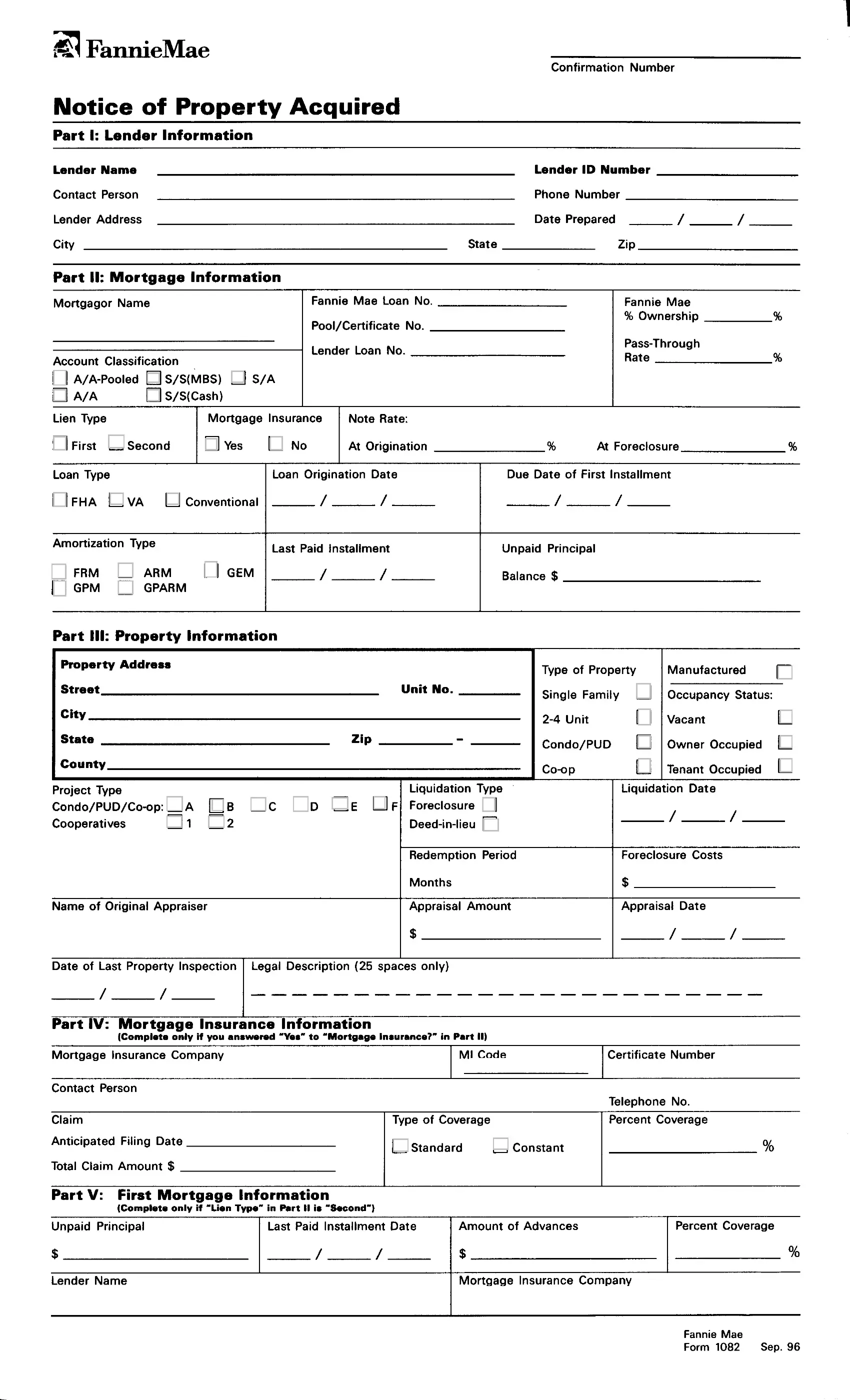

- Business PDF Forms - Fillable and Printable

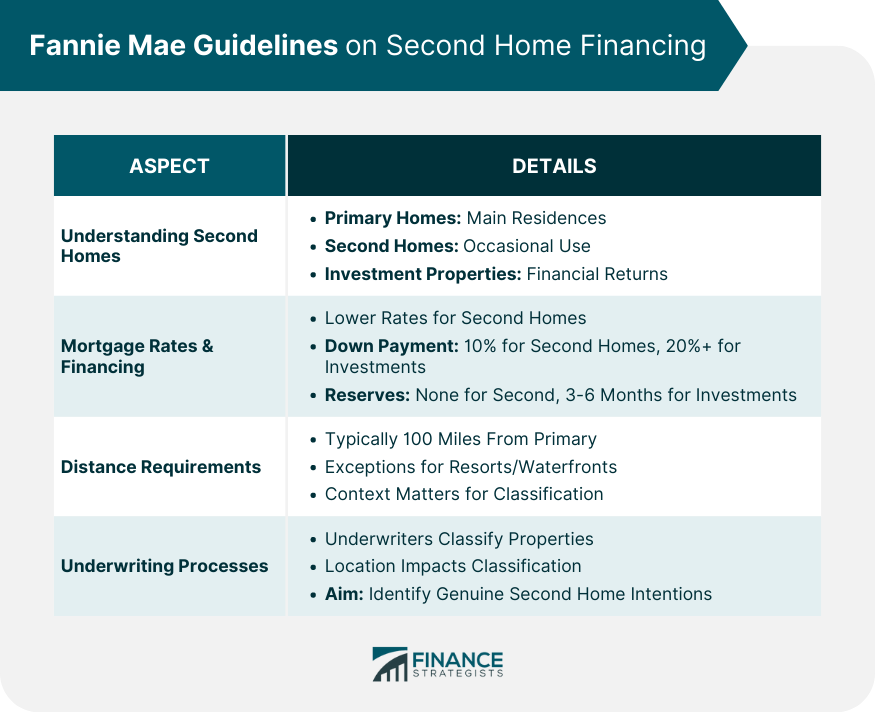

- Fannie Mae Guidelines on Second Home Financing

- Ex-Fannie Mae Chief Is Dismissed From Investors’ Suit - The New York Times

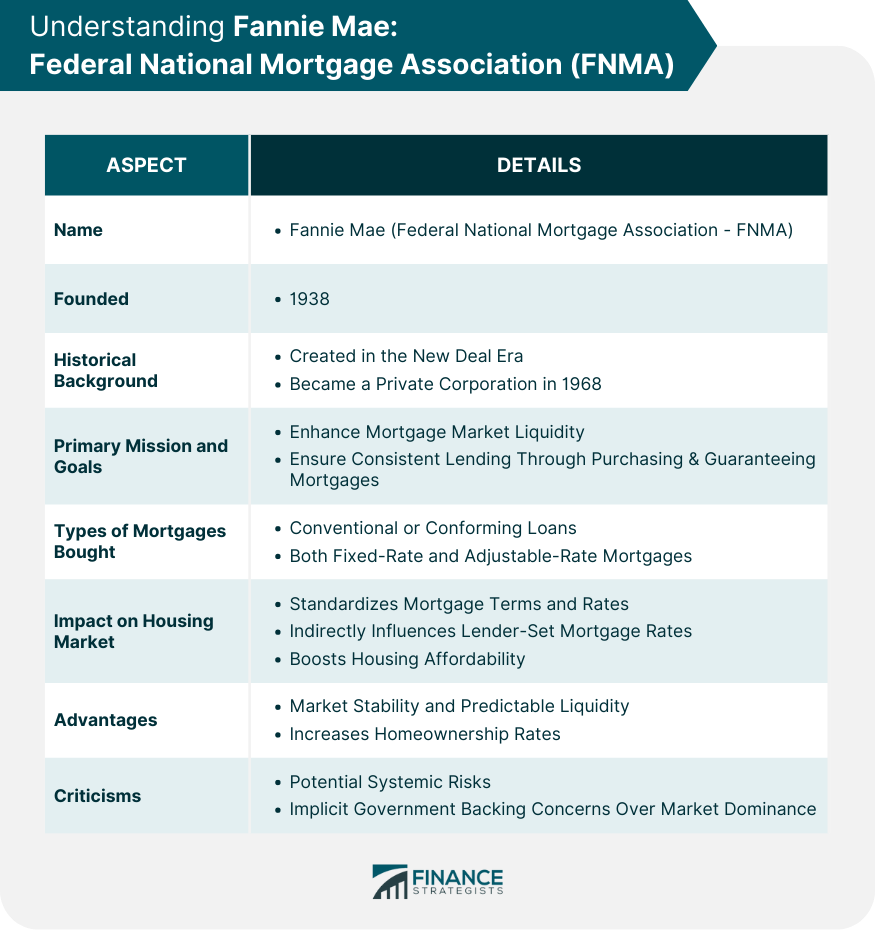

- Fannie Mae vs Freddie Mac vs Ginnie Mae | Finance Strategists

- Fannie Mae Corrects Its Title Insurance Pilot Program Mistake ...

The terminations, which were announced recently, are the result of an internal investigation that uncovered evidence of fraudulent activities among a significant number of Fannie Mae employees. According to sources, the employees in question were found to have engaged in a range of illicit activities, including falsifying documents, manipulating credit scores, and misrepresenting loan information. These actions, which were allegedly carried out to boost loan production and meet sales targets, have serious implications for the integrity of the mortgage market and the trust that homeowners place in lenders.

Background on Fannie Mae

However, the recent scandal has raised questions about the organization's internal controls and its ability to prevent fraudulent activities. The fact that over 100 employees were involved in the alleged fraud suggests a systemic problem that may have gone undetected for some time. As a result, regulators and lawmakers are calling for greater oversight and accountability within the mortgage industry.

Consequences of the Scandal

In addition, the scandal has damaged the reputation of Fannie Mae and the mortgage industry as a whole. The loss of public trust could have long-term consequences, including reduced demand for mortgage products and decreased investor confidence. As the industry struggles to recover from the scandal, it is clear that significant reforms are needed to prevent similar incidents in the future.

Reforms and Next Steps

In response to the scandal, Fannie Mae has announced plans to implement new internal controls and strengthen its compliance procedures. The organization will also be working closely with regulators to ensure that all necessary steps are taken to prevent similar incidents in the future.Furthermore, lawmakers are calling for greater oversight and accountability within the mortgage industry. This may include increased regulatory scrutiny, stricter lending standards, and tougher penalties for those found guilty of fraud. As the industry moves forward, it is clear that significant reforms are needed to restore public trust and ensure the integrity of the mortgage lending process.

In conclusion, the Fannie Mae scandal has sent shockwaves throughout the mortgage industry, highlighting the need for greater oversight and accountability. As the industry struggles to recover from the scandal, it is clear that significant reforms are needed to prevent similar incidents in the future. With the implementation of new internal controls and stricter regulatory scrutiny, the mortgage industry can begin to rebuild trust and ensure the integrity of the mortgage lending process. Note: This article is for general information purposes only and is not intended to provide legal or financial advice.