Table of Contents

- Is Target (TGT) stock a buy ahead of next week’s earnings? | AlphaStreet

- Is Target Stock a Buy on the Dip After Earnings? | Kiplinger

- Target Stock Photo 367837634 : Shutterstock

- Why Did Target Stock Crash In May; Is It A Buy Now? (NYSE:TGT ...

- The Target Icon Target Symbol Flat Vector Illustratio - vrogue.co

- The Really Dumb Reason Why Target Stock Is at Risk

- Buy Target Stock and Its 3% Dividend Yield? Here’s the Setup. - TheStreet

- Target stock photo. Image of target, center, color, sport - 25033160

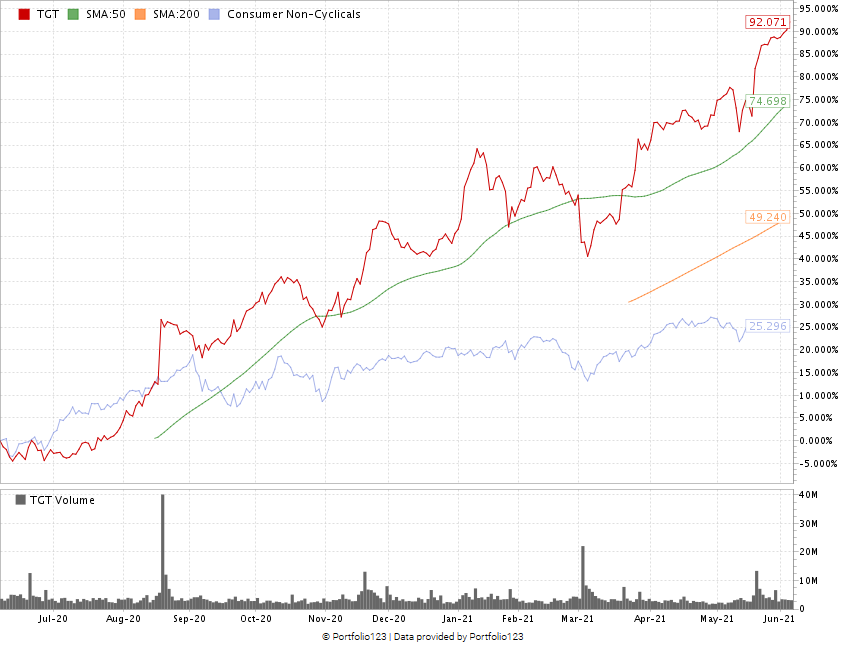

- Target Stock: A Strong Bullish Buy for the Post-COVID Retail Surge

- Target board — Stock Photo © get4net #4289732

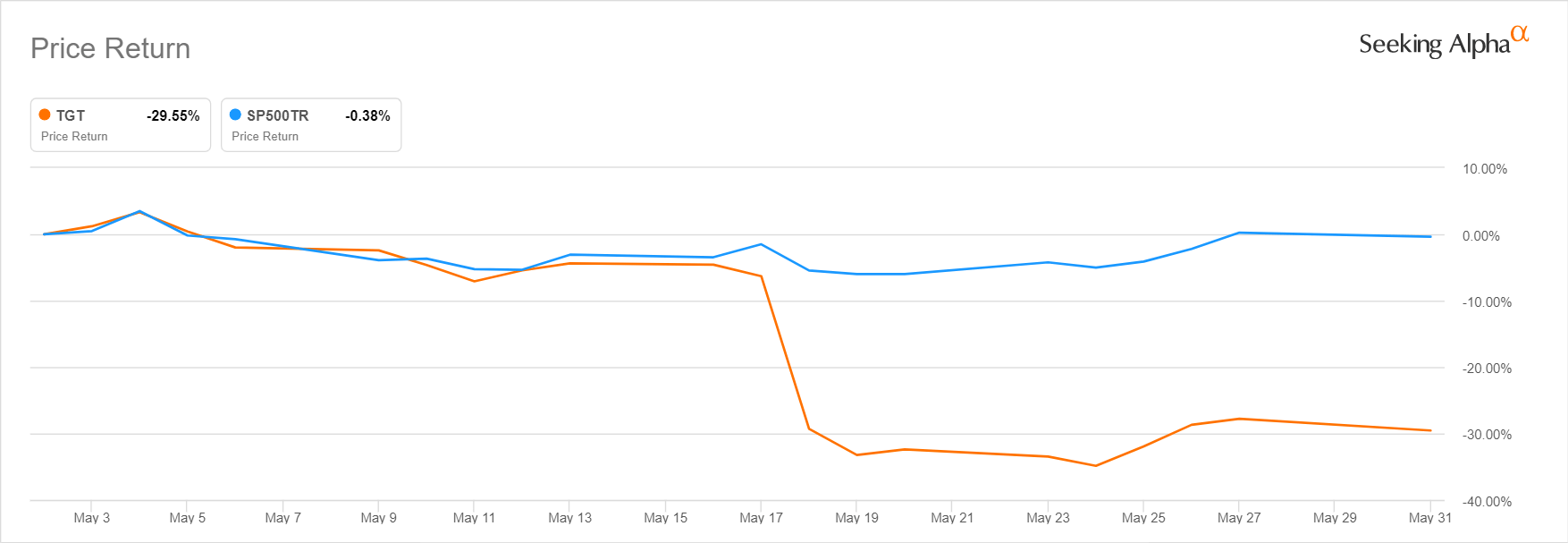

Current Stock Price and Trends

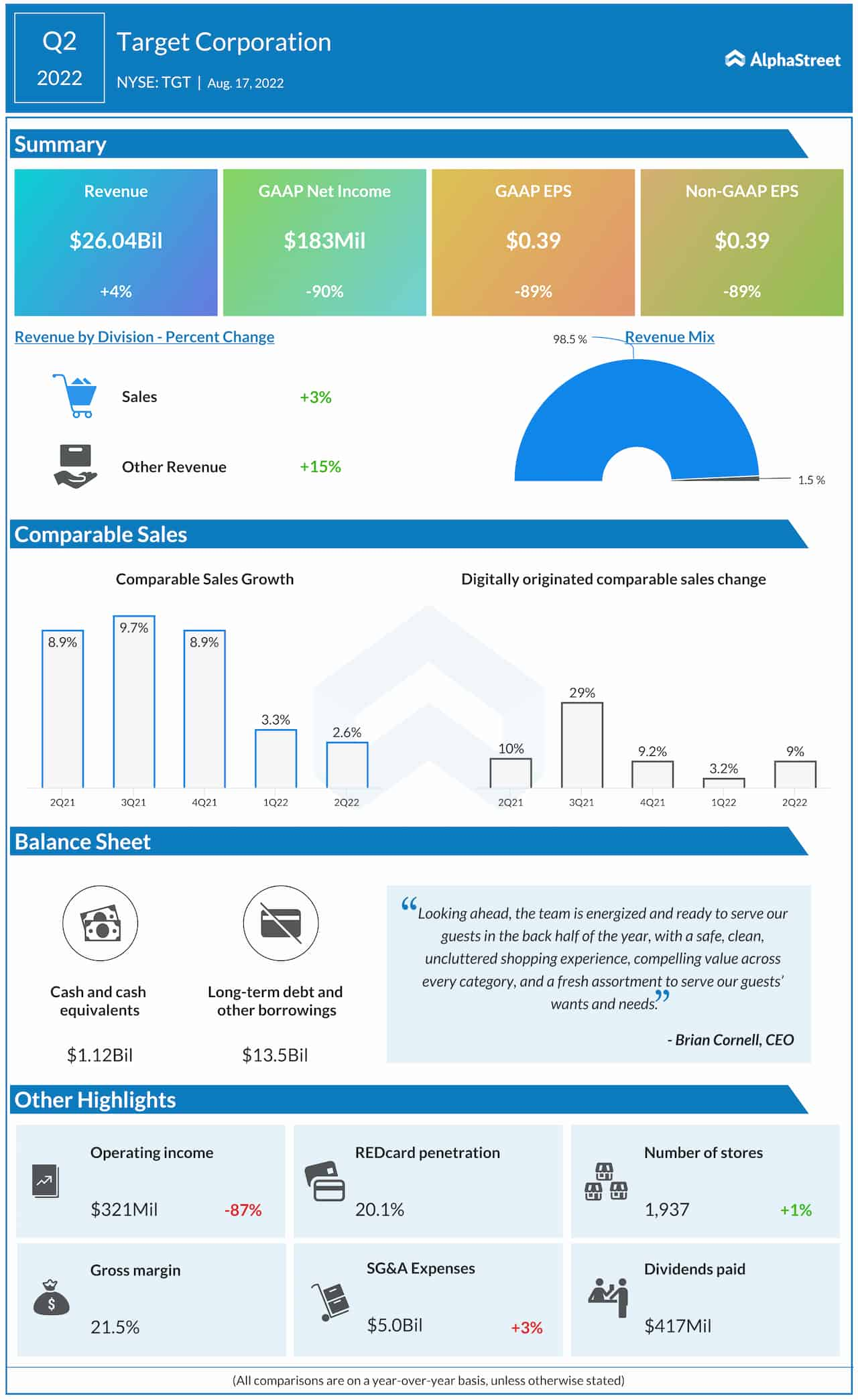

News and Updates

Google Finance Insights

Using data from Google Finance, we can gain a deeper understanding of Target Corp's stock performance and trends. The platform provides a range of tools and features, including real-time stock quotes, charts, and news updates. According to Google Finance, Target Corp's stock has a beta of 0.93, indicating that it is less volatile than the overall market. The platform also provides insights into the company's financials, including its revenue, net income, and profit margins. Target Corp's revenue has grown steadily over the past few years, with a compound annual growth rate (CAGR) of 3.5%. The company's net income has also increased, with a CAGR of 5.6% over the past five years. In conclusion, Target Corp's stock price and news have been positive in recent months, driven by the company's strong financial performance and efforts to adapt to changing consumer behavior. With its diverse portfolio of products and services, the company is well-positioned to continue to grow and thrive in the competitive retail landscape. Using data from Google Finance, investors can gain a deeper understanding of the company's stock performance and trends, and make informed investment decisions. As the retail landscape continues to evolve, Target Corp is likely to remain a closely watched stock in the market.Keyword: Target Corp, TGT, stock price, Google Finance, retail, e-commerce, sustainability, social responsibility