As a county office, it's essential to stay up-to-date with the latest tax forms and regulations to ensure compliance with the Internal Revenue Service (IRS). One crucial form that requires attention is the IRS Form W-9 (2025), also known as the Request for Taxpayer Identification Number and Certification. In this article, we'll delve into the details of the IRS Form W-9 (2025) and provide a comprehensive guide for county offices to navigate this process efficiently.

What is IRS Form W-9 (2025)?

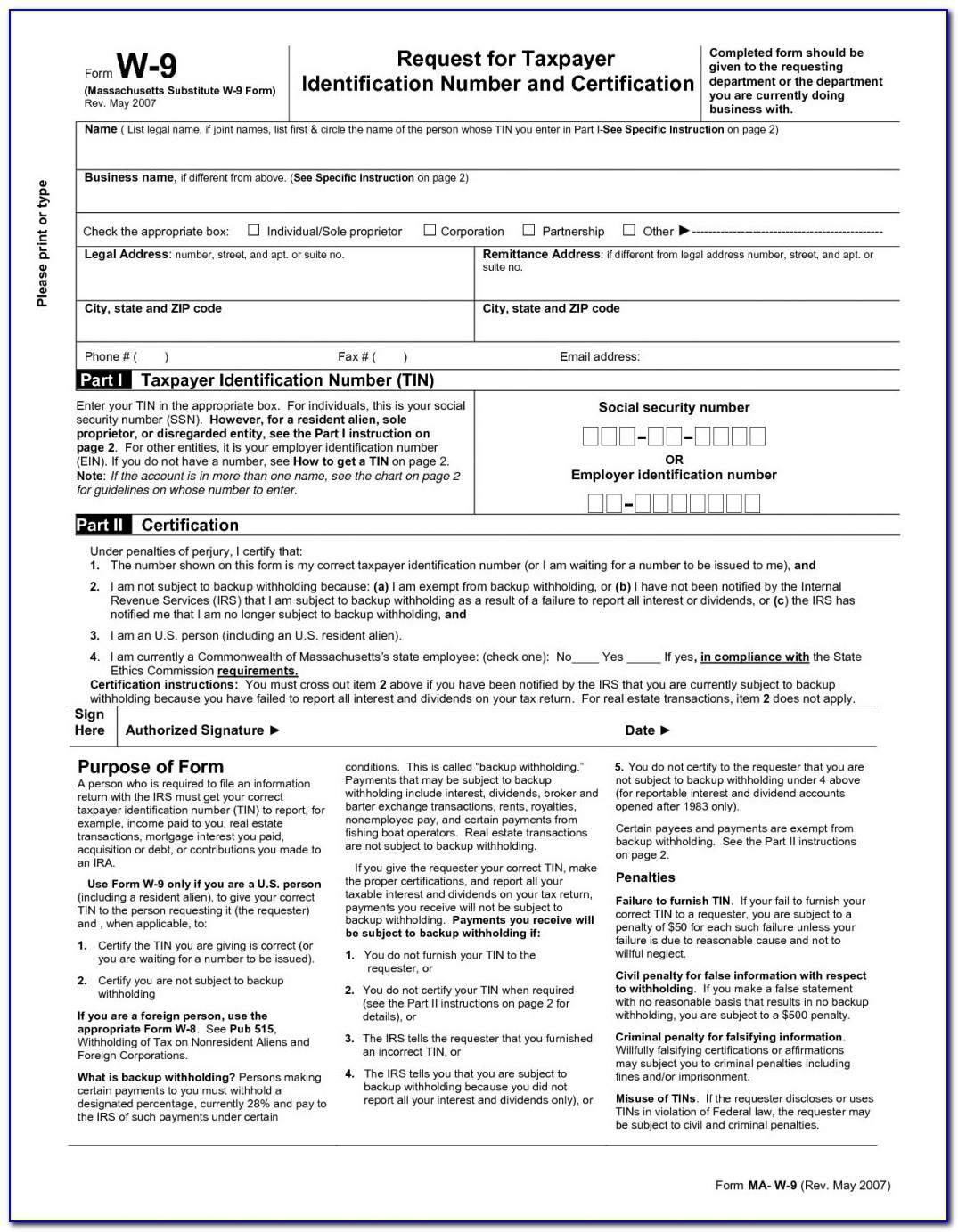

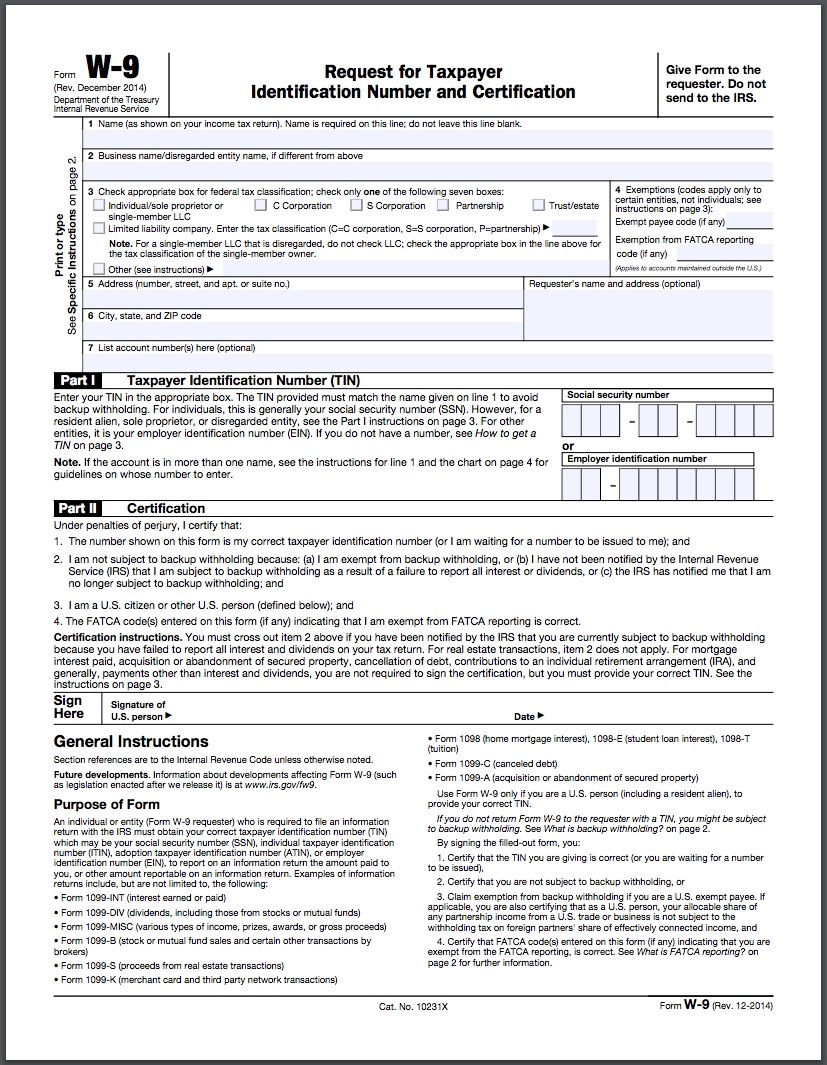

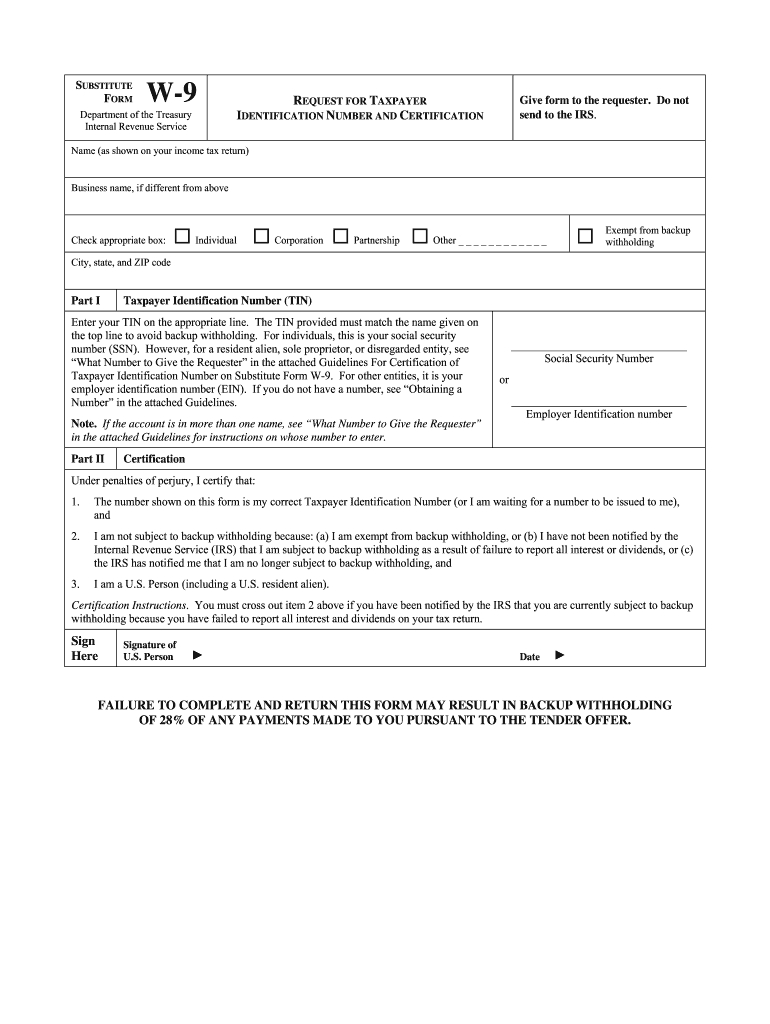

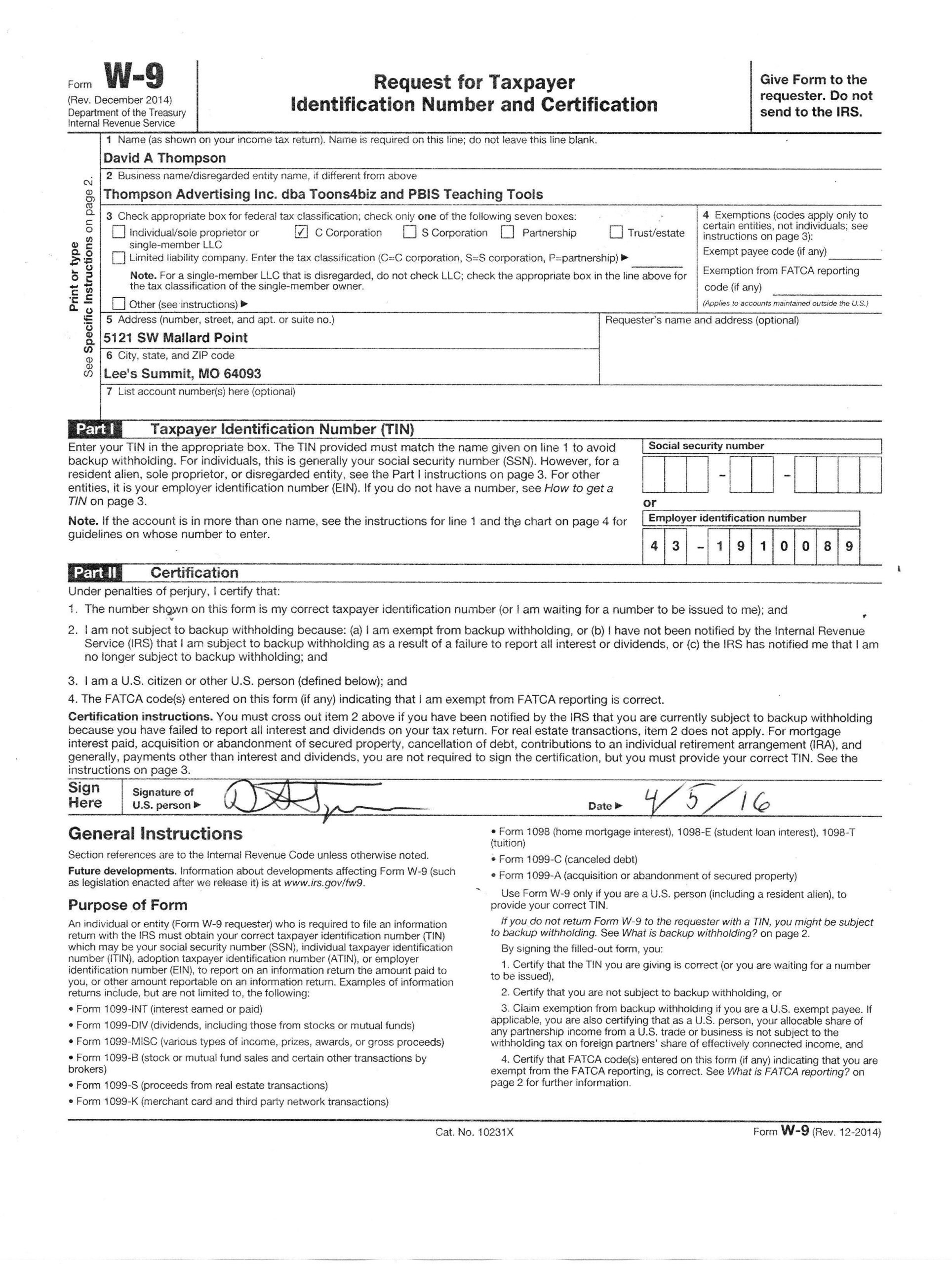

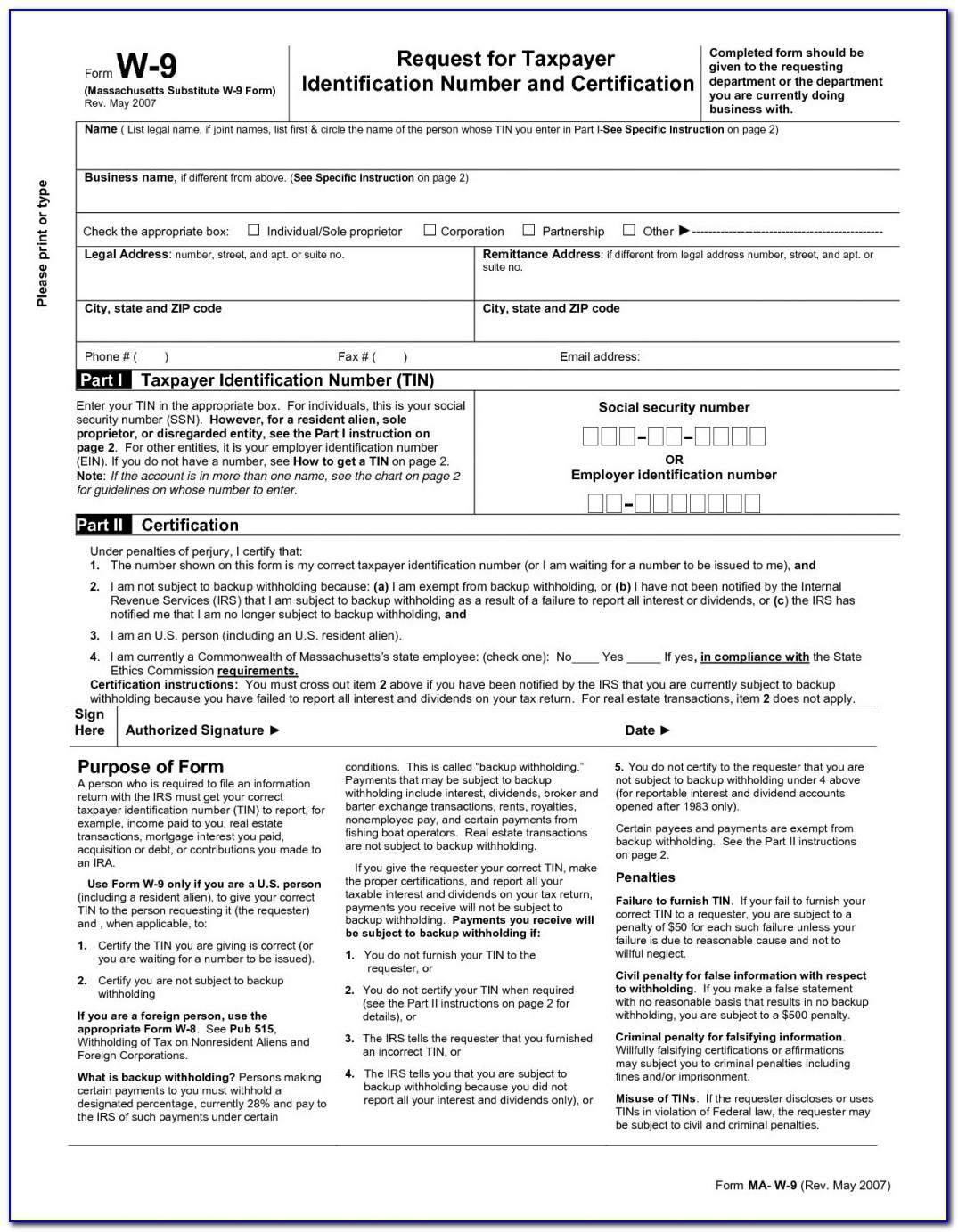

The IRS Form W-9 (2025) is a standard form used by the IRS to collect taxpayer identification information from individuals and businesses. The form requires the taxpayer to provide their name, address, taxpayer identification number (TIN), and certification that they are not subject to backup withholding. The TIN can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

Who Needs to Complete IRS Form W-9 (2025)?

County offices need to complete the IRS Form W-9 (2025) for various purposes, including:

Hiring independent contractors or freelancers

Paying rent or royalties to individuals or businesses

Making payments to vendors or suppliers

Receiving payments from the government or other organizations

Any individual or business that receives income from a county office may be required to complete the IRS Form W-9 (2025) to provide their taxpayer identification information.

How to Complete IRS Form W-9 (2025)

Completing the IRS Form W-9 (2025) is a straightforward process. Here are the steps to follow:

1. Download the form from the IRS website or obtain a copy from the county office.

2. Fill in the required information, including name, address, and TIN.

3. Certify that you are not subject to backup withholding.

4. Sign and date the form.

5. Return the completed form to the county office or the requesting party.

Importance of Accurate Completion

Accurate completion of the IRS Form W-9 (2025) is crucial to avoid any potential issues with the IRS. Inaccurate or incomplete information can lead to delays in payment processing, fines, or even audits. County offices must ensure that they verify the taxpayer identification information and certify that the individual or business is not subject to backup withholding.

In conclusion, the IRS Form W-9 (2025) is a critical form for county offices to understand and complete accurately. By following the guidelines outlined in this article, county offices can ensure compliance with the IRS regulations and avoid any potential issues. If you have any questions or concerns about completing the IRS Form W-9 (2025), consult with a tax professional or the IRS directly.

By staying informed and up-to-date with the latest tax forms and regulations, county offices can maintain a smooth and efficient operation, ensuring that they provide the best possible services to their constituents.