Are you curious about the Alaska Permanent Fund Corporation (APFC) and its role in managing the state's wealth? Look no further! In this article, we'll delve into the most frequently asked questions about APFC, providing you with a comprehensive understanding of this vital institution. Whether you're a resident of Alaska or simply interested in learning more, this guide is designed to inform and enlighten.

What is the Alaska Permanent Fund Corporation (APFC)?

The Alaska Permanent Fund Corporation is a state-owned corporation established in 1976 to manage the Alaska Permanent Fund, a constitutionally established fund that invests a portion of the state's oil revenues. The APFC's primary objective is to prudently manage the fund's assets to provide long-term financial returns and benefits to the state and its residents.

What is the purpose of the Alaska Permanent Fund?

The Alaska Permanent Fund was created to save a portion of the state's oil revenues for future generations. The fund's purpose is to provide a sustainable source of revenue for the state, reducing its dependence on volatile oil prices and ensuring a stable financial future. The fund's returns are used to support essential public services, such as education, healthcare, and infrastructure, as well as to distribute an annual dividend to eligible Alaska residents.

Frequently Asked Questions about APFC

Here are some of the most frequently asked questions about the Alaska Permanent Fund Corporation:

Q: How is the APFC governed?

The APFC is governed by a six-member board of trustees, appointed by the Governor and confirmed by the legislature. The board is responsible for setting the corporation's investment policies and overseeing its operations.

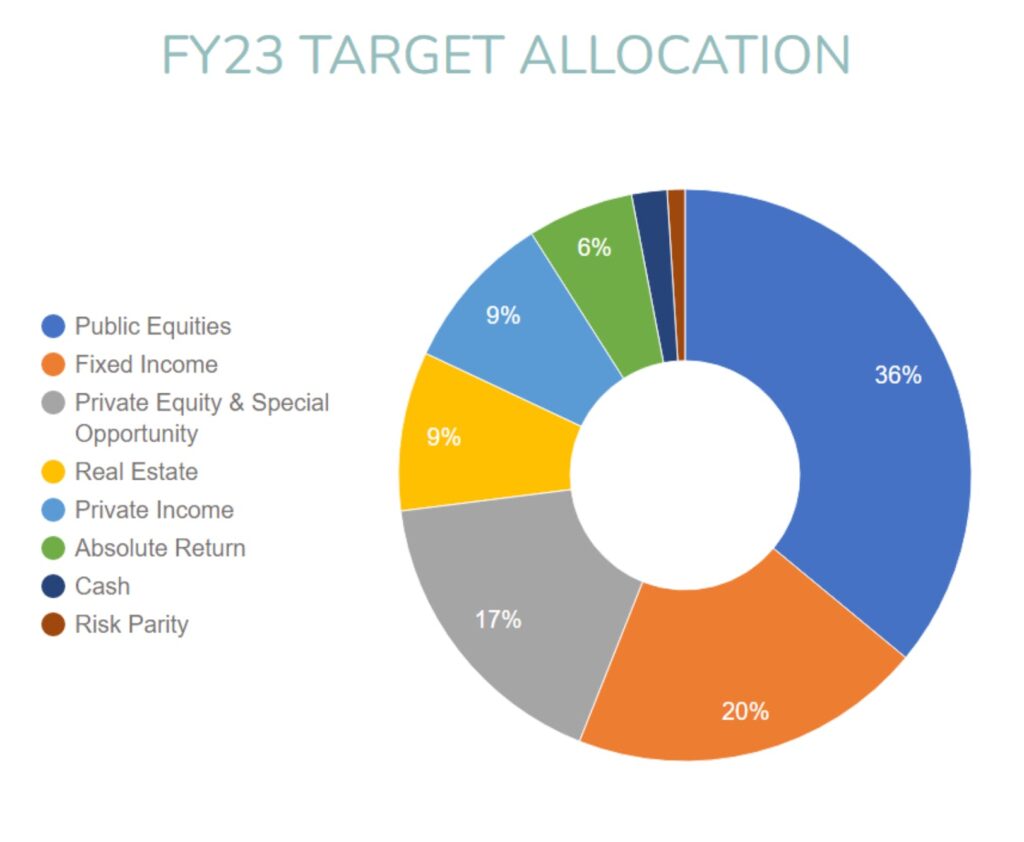

Q: What types of investments does the APFC make?

The APFC invests in a diversified portfolio of assets, including stocks, bonds, real estate, and private equity. The corporation's investment strategy is designed to maximize returns while minimizing risk.

Q: How are APFC's investments performing?

The APFC's investments have consistently outperformed their benchmarks, with the fund's value growing from $1.2 billion in 1982 to over $65 billion today.

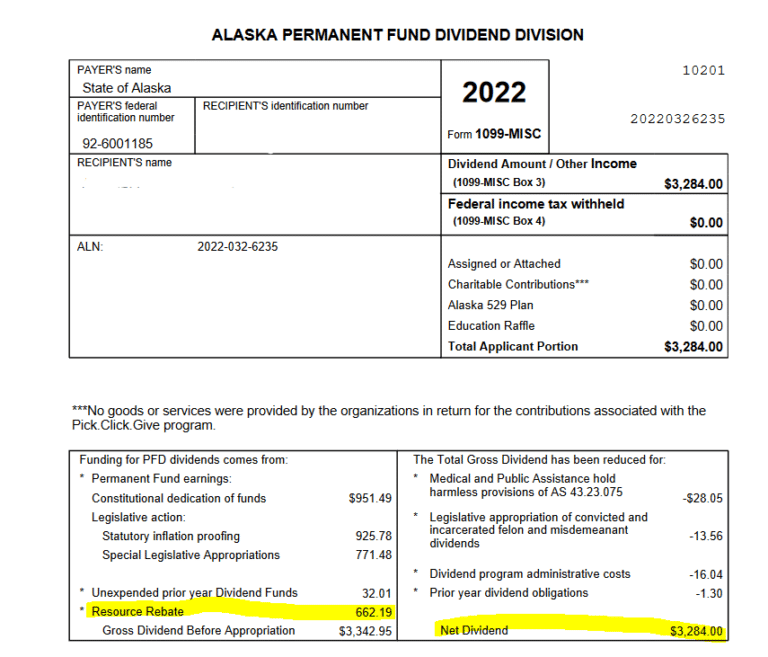

Q: Who is eligible for the Permanent Fund Dividend (PFD)?

The PFD is available to eligible Alaska residents who have lived in the state for at least one calendar year. The dividend amount varies from year to year, depending on the fund's performance and the state's budget.

The Alaska Permanent Fund Corporation plays a vital role in managing the state's wealth and providing long-term financial benefits to its residents. By understanding the APFC's purpose, governance, and investment strategies, you can gain a deeper appreciation for the importance of this institution. Whether you're an Alaska resident or simply interested in learning more, we hope this guide has provided you with valuable insights into the world of APFC. For more information, visit the APFC website or contact their office directly.

This article is for informational purposes only and is not intended to provide investment advice. If you have specific questions or concerns about the APFC or the Permanent Fund Dividend, please consult the official APFC website or contact a financial advisor.

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings, subheadings, and bold text used to highlight important keywords and questions. The article is written in a clear and concise manner, making it easy to understand for readers.